The Risks of Short-Term Rentals are significant for those investing in Airbnb properties. Understanding the market can be tricky, with fluctuations affecting occupancy rates and revenue. Additionally, regulatory changes can pose legal challenges that every investor must be aware of. Property maintenance often requires vigilant attention, and financial implications can include unexpected costs. Learn about these risks to make informed decisions in your Airbnb investing journey.

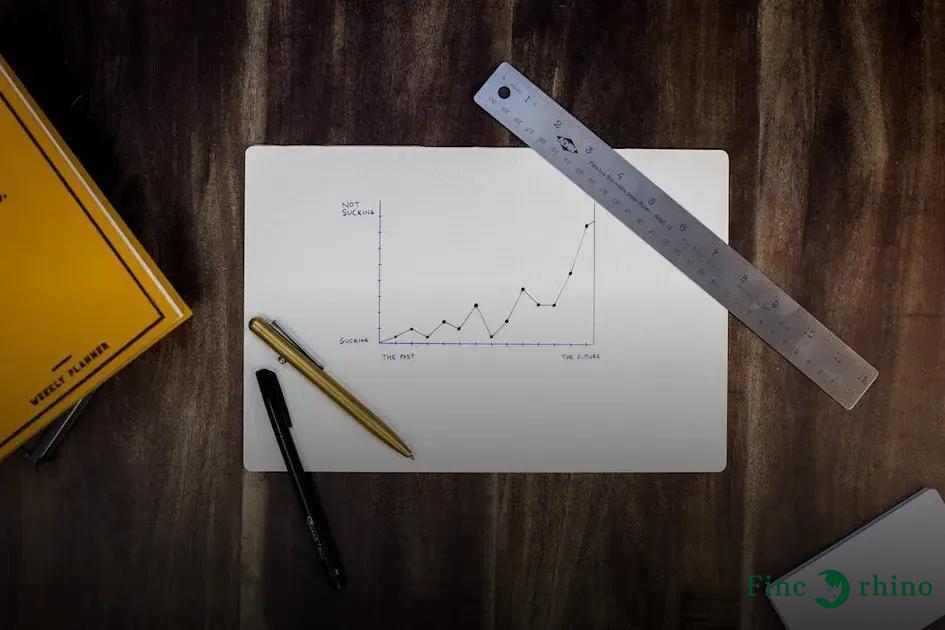

Understanding Market Fluctuations

Market fluctuations can greatly impact short-term rental investments like those on Airbnb. Investors should be aware that these fluctuations are generally unpredictable and can lead to unexpected changes in rental income. High demand periods can result in increased bookings, but low seasons might result in reduced occupancy rates.

Analyzing Market Trends

Some key factors to watch include local events, which can drive up demand temporarily. Additionally, economic changes like recessions can reduce travel, affecting the short-term rental market.

Development and Growth

In rapidly developing areas, property values can rise, making investments seem lucrative. However, enter into these markets cautiously as not all will continue to grow at the same rate. Sudden market corrections can lead to losses if properties are overvalued.

External Influences such as political changes and natural disasters can also lead to dramatic shifts in the market. It’s essential to have strategies in place for managing downturns.

Understanding these dynamics can help investors make informed decisions, capitalizing on opportunities during high periods and preparing contingencies for downturns.

Regulatory and Legal Challenges

Short-term rental investments, such as those offered on platforms like Airbnb, can face significant regulatory and legal challenges that might impact investors and property owners. Various regions have enacted strict regulations to address concerns over housing shortages and community disruptions caused by short-term rentals. These laws may vary widely from one location to another, affecting how and where you can operate your rental property.

In many cities, there are zoning laws and ordinances that limit the types of properties that can be rented short-term or may require landlords to obtain specific licenses. Failure to comply with these regulations can lead to fines and legal penalties. Property owners must stay informed about local legislation to ensure their investments remain compliant.

Legal changes are frequent and sometimes abrupt, posing a risk to investors who are caught off guard by new rules or more stringent enforcement practices. Furthermore, many regions impose restrictions on the number of nights a property can be rented, influencing the potential revenue of the investment.

It’s crucial for investors in the short-term rental market to consult with local attorneys or specialists in property law. They can provide guidance on navigating these challenges and ensure compliance with all applicable laws. Being proactive and informed about the legal environment can help mitigate potential risks associated with short-term rental investments.

Property Maintenance and Management

Managing and maintaining your properties effectively is crucial to maximize the rewards of short-term rentals like Airbnb. A comprehensive property management strategy involves ensuring your rental remains in prime condition to attract guests.

Regular Inspections

ensure all facilities function properly, and appliances are up-to-date, reducing emergency repairs’ likelihood. Cleanliness, including professional cleaning services between guest stays, plays a key role in delivering a positive guest experience.

Efficient management also involves setting clear, easily understandable guest instructions. This includes check-in and check-out procedures, using appliances, and emergency contact information. Responsive communication with guests ensures issues are swiftly addressed, improving reviews and potentially increasing bookings.

Hiring a skilled property manager can offer peace of mind for busy investors. They handle everything from guest screenings to maintenance scheduling, streamlining operations. For those who prefer autonomy, numerous tech-forward solutions, such as rental management software, exist to aid in scheduling cleanings, tracking income, and even dynamic pricing adjustments.

Ignoring proper management can result in wear and tear, diminished property value, and negative guest reviews, ultimately affecting the profitability of short-term rentals. Understand that maintaining a high occupancy rate requires ongoing diligence and effective management strategies. While the upfront work is significant, a well-maintained property promises higher returns and consistent reservations.

Financial Implications and Hidden Costs

When considering investment in short-term rentals, one must not overlook the potential financial implications and hidden costs involved. While platforms like Airbnb can promise lucrative returns, unforeseen expenses might arise, affecting your overall profitability.

Property management fees can quickly accumulate. Whether you opt for professional services or manage it yourself, factors such as cleaning, marketing, and guest communication involve ongoing costs. Additionally, maintaining a listing’s high ranking on hosting platforms may require regular enhancements and upgrades to your property, further impacting your budget.

Another hidden cost can be seasonal fluctuations in demand. During off-peak periods, occupancy rates decline, which could lead to unexpected drops in income. As a result, it’s crucial to account for these potential voids in booking when calculating potential annual earnings.

Insurance is another area often overlooked by new investors. Regular homeowner policies may not cover short-term rental risks, necessitating specialized insurance. These policies may entail higher premiums, adding to the slew of ongoing expenses.

Compliance costs should also be considered. Meeting local regulations with respect to safety standards, occupancy taxes, and other compliance requirements can create additional financial obligations. Understanding these potential costs upfront helps avoid unwelcome surprises later on.

In summary, a successful short-term rental venture requires careful analysis of all financial elements. These implications highlight the importance of comprehensive budgeting and strategic financial planning in safeguarding against potential pitfalls.