Are you eager to dive into the lucrative world of real estate? With the right strategies, you can start from scratch and build a thriving real estate empire. This guide will walk you through the essential steps, including understanding the market dynamics, setting clear goals, securing financing, and managing your investments. By focusing on these key aspects, you’ll be well-equipped to make informed decisions and grow your portfolio successfully.

Understanding the Real Estate Market

When understanding the real estate market, it’s crucial to analyze current trends and fluctuations. Pay close attention to key indicators such as interest rates, housing supply, and demand dynamics. This will help identify the best times to invest, ensuring both profitability and growth of your real estate empire. Analyze geographic regions and their potential for development. Urban areas often offer better opportunities due to higher demand for housing and commercial spaces.

Pay attention to the appreciation potential within different markets. Research historical data and projections to understand where property values are likely to increase. Understanding various market cycles, such as buyer and seller markets, can significantly impact your strategy. This detailed knowledge will prepare you to make informed decisions and adapt your investment approach according to market shifts. Consider leveraging local insights and working with industry experts to enhance your understanding of the market intricacies.

Setting Clear Investment Goals

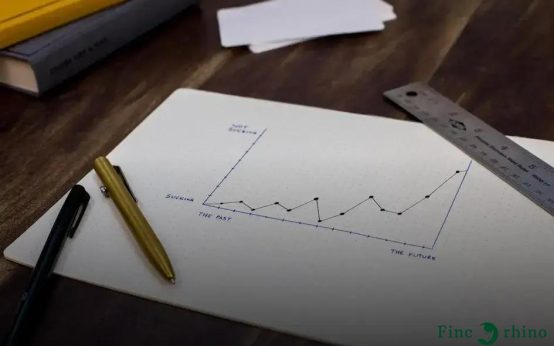

Setting clear investment goals is a cornerstone principle when aiming to build a real estate empire. It’s crucial to specify what you want to achieve and how you plan to do it. Start by defining what success looks like to you in the real estate space. Consider if your focus is on generating passive income, long-term appreciation, or both. This clarity will help guide your decisions consistently.

Decide on the property type that aligns with your goals. Are you looking into residential properties, or does commercial real estate suit your objectives better? Each type comes with its own set of opportunities and risks, so it’s important to choose what suits your appetite and expertise.

Set a timeline for your goals. Determine short-term milestones as well as long-term aspirations. These timelines need to be realistic and adjustable as you learn and grow in the market. Having a clear timeline will keep you focused and motivated, allowing you to measure progress effectively.

Quantify your goals. Decisions in real estate should not be vague. Set numerical targets, like a specific number of properties or a determined amount of revenue per year. These metrics will be your benchmarks of success and help in steering clear from distractions.

Additionally, consider your risk tolerance levels. Real estate investment is not without its challenges and potential drawbacks. By understanding how much risk you are willing to take, you can better align your strategy to meet your personal comfort levels while aiming for growth.

Financing Your Real Estate Ventures

Financing your real estate ventures is a critical step in building a successful empire. The right financing can unlock opportunities, allowing you to expand your portfolio. One of the most common ways to finance property purchases is through traditional bank loans. These loans typically require a down payment and the approval depends on your credit score and financial history.

Exploring Alternative Financing

While traditional loans are common, alternative financing options like hard money loans and private money lenders can be valuable. These alternatives often offer quicker approvals and are more flexible, albeit typically at higher interest rates. Real Estate Investment Trusts (REITs) also provide a less direct form of investment in real estate, allowing you to access large-scale properties without individual ownership.

Consider using the power of syndication, where you pool funds with other investors to purchase properties. This method reduces individual financial risk while expanding investment potential.

Leveraging Equity

As you acquire properties, you build equity that can be used for further investments. Leveraging this equity through HELOCs (Home Equity Line of Credit) can provide a flexible financing tool to fuel growth. This approach must be managed carefully to avoid over-leverage risks.

Strategically plan your financing by understanding the loan terms, interest rates, and potential impact on cash flow. This planning is essential for maintaining a strong financial base as you scale your real estate empire.

Building a Strong Portfolio

To build a strong portfolio in real estate, focus on diversification. This will help mitigate risks and maximize opportunities. Begin by identifying various types of properties such as residential, commercial, or vacation rentals. Each property type offers unique growth and income potential.

It’s crucial to research and understand the local market trends. Analyze historical data and future projections to make informed decisions. Moreover, invest time in networking with professionals in the field. Real estate agents, property managers, and other investors can provide insights and opportunities that may not be immediately apparent.

Capitalize on technology by utilizing property management software and online platforms for tracking market trends. Regularly assess your portfolio’s performance and be ready to make adjustments or additions when necessary.

Collaborating with experienced partners or hiring professional services can also bolster your efforts. A well-curated team can handle complexities and expand your reach into new markets efficiently.

Remember, patience, careful planning, and continual learning are key components in creating and maintaining a robust real estate portfolio.

Scaling and Managing Your Empire

Efficiently scaling your real estate empire requires strategic planning and effective management. Focus on Diversification: Spread investments across different property types and locations to minimize risks and maximize returns.

Optimize Property Management

by hiring experienced managers or utilizing property management software. This ensures operations run smoothly and tenant retention remains high. Monitor Market Trends: Stay informed about the latest market trends to make data-driven decisions. Regular assessments can help you adjust your strategies as needed.

Leverage Technology

to enhance your operations. Use analytics tools to gain insights into performance and identify areas for improvement. Additionally, automation can streamline processes, reducing costs and increasing efficiency. Networking and Mentorship: Build a network of professionals for insights and opportunities within the real estate industry. Consider finding a mentor for guidance and advice on complex issues.

Keep Learning:

Attend seminars, workshops, and online courses to stay updated on industry changes and new strategies. Continuous learning is key to staying competitive and maintaining growth momentum. Evaluate and Adapt: Regularly evaluate your portfolio’s performance and be willing to adapt strategies to changing conditions. Flexibility is crucial to sustaining growth.